Cash & profitability are the name of the game

Reducing cost and financing is the most important task and challenge for SMEs, for this can cause huge financial impact to the companies’ cash flow, business and growth. As the old saying always said “money is the king”, especially in the current global economic circumstances, accessing extra cash is more challenging than before - companies need to focus on discovering the hidden value in working capital.

Truly, an effective working capital management can indeed release significant and sustainable cash flow from working capital. The problem is how? Before revealing the answer, let’s take a look at the liquidity problem.

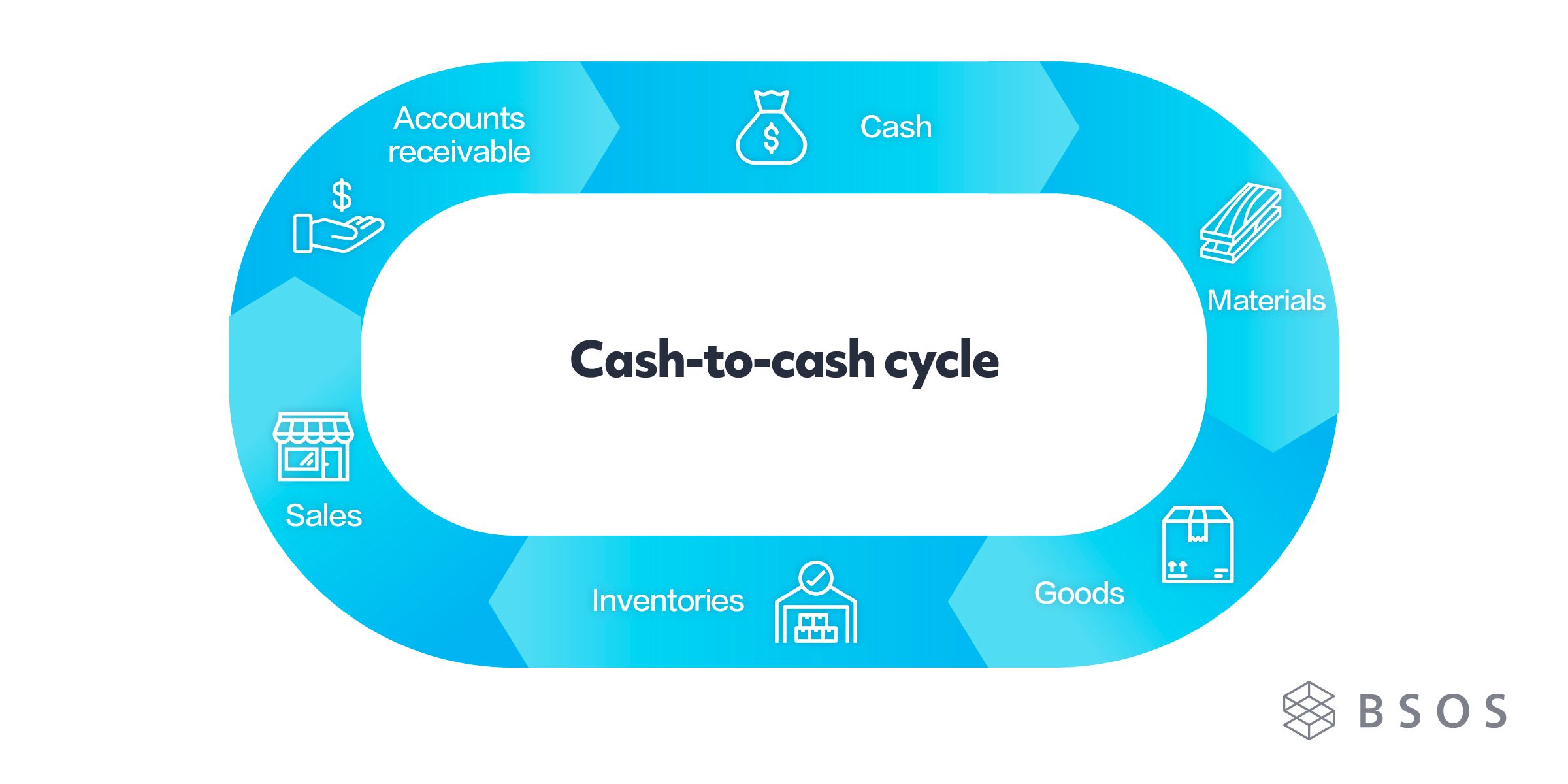

Cash-to-cash cycle

Before we introduce the Cash-to-cash cycle, we need to understand the working capital definition. Working capital is the money that the company invested in the operating. So, the need of working capital directly depends on the cash spending. How about the cash-to-cash cycle? The cash-to-cash cycle is the total process time that cash transforms into something, and then transforms back to cash. For example, a company converts its cash into materials; then converts materials into inventories; next converts inventories into goods; converts goods into sales; then converts sales into accounts receivable; and finally converts accounts receivable back into cash.

The cash-to-cash cycle is too long, whereas based on the payment terms of accounts receivable, it could be much longer - liquidity stucks here.

The cash-to-cash cycle is too long, whereas based on the payment terms of accounts receivable, it could be much longer - liquidity stucks here.

Current Market Dilemma

Vendors around the world have $43 trillion tied up in accounts receivable every single day. Also, according to the research by J.P. Morgan, there are 8 million small businesses that couldn't survive if the cash buffer is lower than 13 days. They have another option - accounts receivable financing. However, the capital provider (banks or factoring companies) finds it hard to verify the authenticity of your accounts receivable, so your application may still end up being rejected. This problem afflicts many businesses around the world.

Game-changer: BSOS, Liquidize Real-world Assets with Web3

The game-changer was born. BSOS SUPLEX - A Sustainable Working Capital Solution for Every Corporate.

SUPLEX nurtures both buyer and seller by connecting global liquidity market and optimizing payment terms within supply chain. With SUPLEX, there is no need to worry about how to handle the constantly changing and even unpredictable capital needs - every corporates can get value from Day 1.

If vendors need funds, vendors can offer discounts to their client in exchange for earlier payments. If their client agrees, vendors can get the funds right away; If their client is unable to pay, due to a lack of funds, they can help vendors verify the invoice and circulate the invoice in the SUPLEX market where a capital provider purchases vendors' invoice and provides the funds that vendors need.

We liquidize the real-world assets from multi-industries with different types of capital providers by blockchain. We form the ecosystem, which leverages CeFi, DeFi and financial institutions to bring better asset liquidity and financing efficiency.

Start for free: https://bsostaiwan.pse.is/3wu8qy