Do you know what real estate, venture capital, and artworks have in common? They are all types of assets that are difficult to trade and have poor liquidity.

Until now.

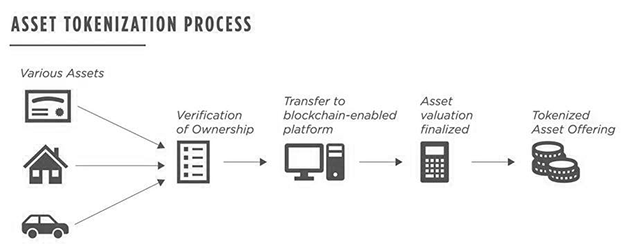

Many companies in the world are beginning to try to unlock a new form of liquidity into these illiquid assets through blockchain technology.

Let us first understand the problem of the above-mentioned illiquid assets.

Why are some assets difficult to flow?

Asset liquidity is highly related to the convenience of trading, and there are many reasons for poor liquidity.

Taking real estate as an example, if one wants to sell a real estate that is worth 10 million USD, it may take some time to find a buyer. There is no open market like the New York Stock Exchange for real estate, and only a few people that are high-net-worth individuals will consider buying. These two factors alone have significantly reduced the number of participants in the real estate market, thereby reducing liquidity.

However, this is not the whole reason.

Real estate transactions usually involve multiple intermediaries and piles of paperwork, which will reduce the speed of currency circulation in the transaction and further leads to the insufficiency in asset liquidity.

At present, most illiquid assets in the world are difficult to trade for at least one of those reasons.

The benefits of improving asset liquidity have already been shared in the previous article, so we will not go into details here.

Let’s talk about why asset digitization can improve liquidity.

Asset digitization provides many benefits of asset liquidity. For example, buying, holding, selling and trading these digital assets will no longer require intermediaries, and in most circumstances, it will not require cumbersome paperwork.

After assets are digitized, there are three important indicators:

Create a public market: By placing assets on the blockchain for transactions, it transfers from the private to the public domain and achieves a more accurate asset valuation. The “Invisible Hand” in economics hence comes into play.

Improve the convenience of trading: It can be proved mathematically that blockchain transactions do not require complicated paperwork and can directly trade digital assets with another person – without intermediaries.

Enhance ownership: By fragmenting different types of assets, those who originally could not afford buying one can finally participate, meaning that there could be a thousand buyers with $1,000 invested per person instead of looking for a buyer with $1,000,000. Asset digitization can generate more traders, easier trading methods and higher transparency, which can increase a large amount of liquidity.

Let’s take a look at the scale of the world’s illiquid asset market:

There is a sum of 43 trillion USD of accounts receivable that is not in circulation

The value of the U.S. real estate alone is 167 billion USD

The value of artworks is 67 billion USD

Asset digitization not only eliminates the friction in traditional financial market, but also opens up an economic model that is unprecedented. For example, it allows you to become part of the owner of the music rights, or even buy a stretch of virtual land.

We are heading in the right direction

Not only blockchain startups, but the traditional financial system also embraces the challenges and benefits of the new technology. Although we may not have reached the destination, we are already on the way. As more and more institutions and customers choose to digitize their assets, real liquidity benefits will begin to emerge.

Start for Free NOW: https://bsostaiwan.pse.is/3y8uwy